The luxury packaging market is estimated to grow at a CAGR of 4.09% to reach US$20.258 billion in 2026 from US$15.298 billion in 2019. The rise in disposable income, adoption of the western culture, and urbanization especially in the emerging economies such as Brazil, China, India, and Australia are leading to the increasing demand for personalized packaging and aesthetically appealing packing of various consumer products such as watches, fragrances, jewelry, cosmetics among other products. Consumers are demanding aesthetically appealing packaging with the perception of value it can add to the product. This factor is acting as the key driver of the luxury packaging market. Further, the rise in awareness about the environment is encouraging the consumer to prefer the packaging of the natural material. The manufacturers are focusing on and introducing sustainable, bio-degradable, or eco-friendly packaging with enhanced functionality and multi-use designs. For instance, in October 2020, The Estée Lauder Companies (ELC) and origins announced a sustainable packaging partnership with SABIC and Albea. Origins, a prestige global skincare brand that provides high-performance formulas powered by nature and proven by science, and its parent company, The ELC, announced a partnership with global chemical industry vendor SABIC and strategic beauty packaging manufacturer Albéa to bring an advanced recycled tube package to market in 2021. This strategic partnership aligns with ELC’s sustainable packaging goals, which includes increasing the amount of post-consumer recycled (PCR) material in its packaging by up to 50% by 2025, and would further Origin’s efforts to ensure that at least 80% of the brand’s packaging by weight is recyclable, refillable, reusable, recycled or recoverable by 2023. Whereas in September 2020, Delta Global created an innovative, eco-friendly packaging solution for high-end fashion mystery box service, Heat with sustainability and innovation taking center stage, this partnership aims to strengthen both brands’ commitment to responsible practices and to mitigate the fashion industry’s impact on climate change.

The outbreak of the Covid-19 pandemic has disrupted the supply chain of the luxury packaging market. However, the market is recovering and the significant effect of the covid-19, in the long run, is unlikely.

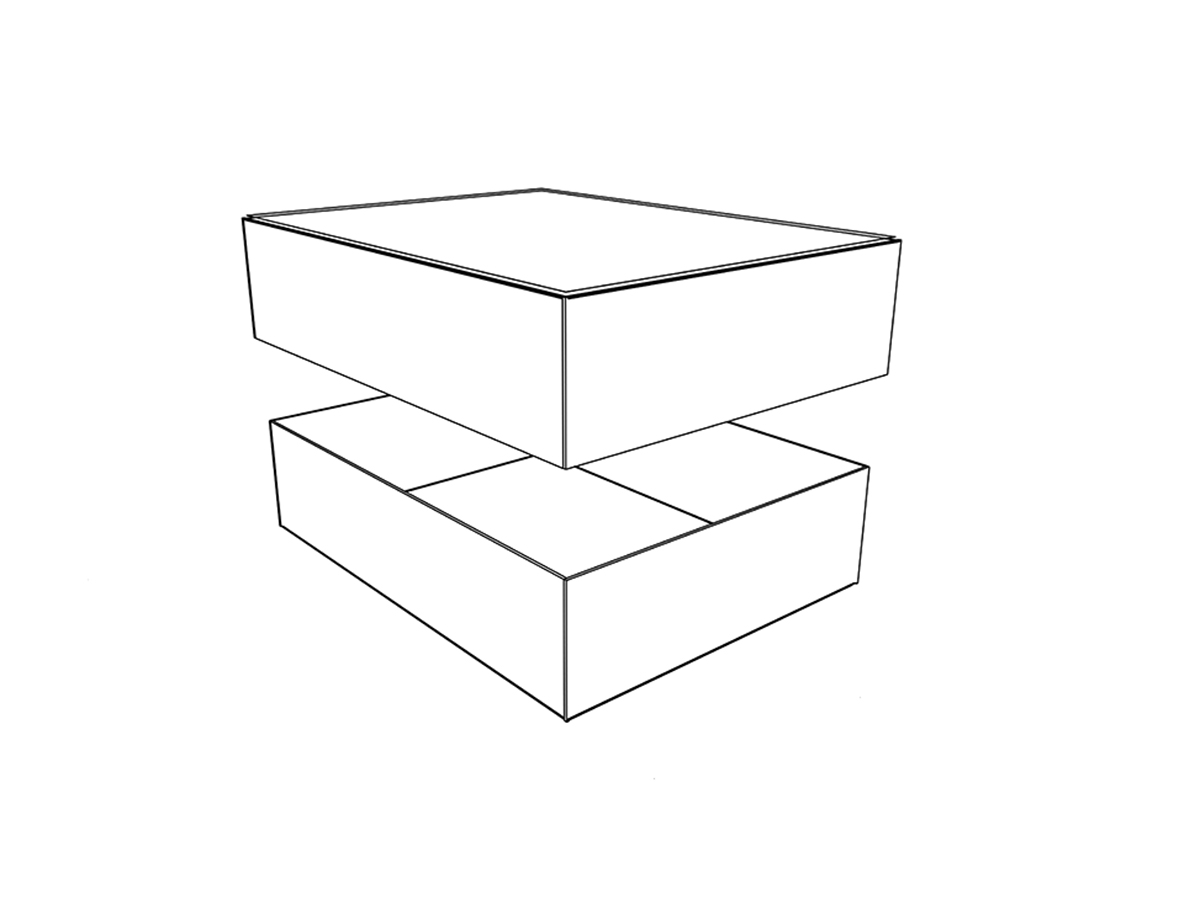

Luxury packaging has been segmented by material as Paperboard, Metal, Glass, Textile, Plastic, and Others. In terms of value paperboard accounts significant share in the market followed by glass. According to the European Paper Recycling Council (EPRC), the paper recycling rate in the region maintained its high recycling numbers in 2019, increasing from 71.7% in 2018 to 72%. This rate was achieved owing to a stable utilization of Paper for Recycling (PfR) in the European paper industry. Metal and plastic are also expected to grow at the noteworthy rate owing to cost benefits it provides over the traditional paper packaging solutions. Besides, innovation in the plastic industry and high demand from end customers are some of the factors driving the demand for plastic luxury packaging solutions and products.

By application, the global luxury packaging market has been segmented as tobacco, premium Beverage watches and jewelry, confectionery, cosmetics and fragrances, and others. Cosmetics and Fragrances hold a significant share of the luxury packaging market due to the rise in the willingness and demand by the consumers to spend more on appealing and luxurious products. The cosmetic and fragrance segment is expected to grow at a significant rate over the forecasted period owing to the rising global ageing population, increased spending on personal grooming by the younger generation, and high demand for natural deodorants and perfumes. Alcoholic drinks also hold a considerable market share owing to the rising consumption of beer and wine. However, watches and jewelry are anticipated to witness the fastest market growth due to increased disposable income and thus, rise in the spending by consumers on these accessories and the high volume of imported watches to be sold in developing economies.

The luxury packaging market is segmented based on geography as North America, South America, Asia Pacific, Europe, and Middle East & Africa. Europe has dominated the market due to factors such as increasing flagship stores and the surge of demand in the online channel of distribution. Other factors also include that the region is home to major luxury packaging manufactures and thus the rise in tourist demand has been witnessed on the luxury products. These factors are driving the demand for luxury packaging in the region and is anticipated to exhibit a significant share in the forecasted period. The main markets in the region include Germany, France, and the United Kingdom. Whereas, the Asia Pacific is expected to witness the highest growth during the forecasted period due to the increase in the disposable income and thus the rise in the expenditure by the consumers on them. The large population and the urbanization is leading to change in the consumer pattern and demand. For instance, according to the National Bureau of Statistics of China, in 2019, about 60.16% of the total population lived in cities. More consumers are demanding luxurious products and the rise in the penetration of the online channel of distribution and innovations in the packaging is further expected to boost the market growth of the luxury packaging market.